who pays sales tax when selling a car privately in ny

The average total car sales tax paid in New York state is 7915. If you buy another car from the dealer at the same time many states offer a trade-in tax exemption that lowers the amount of sales tax.

New York Car Sales Tax Calculator Ny Car Sales Tax Facts

However you do not pay that tax to the car dealer or individual selling the car.

. Register and title the vehicle or trailer. When a vehicle is sold in a private sale both the buyer and the seller must fill out a Statement of Transaction form DTF-802 which is then submitted to the New York DMV where the sales tax is calculated and collected from the buyer. If you bought your vehicle from another person in a private sale both you the buyer and the seller must complete the Statement of Transaction Sales Tax Form pdf at NY State Department of Tax and.

License plates and registrations buyers must visit a motor vehicle service center to register a vehicle for the first time. Sales of most food for home consumption. Do not let a buyer tell you that you are supposed to pay the sales tax.

Sign the bill of sale even if it is a gift pay sales tax or have proof of an exemption. When you buy a car from a private seller you dont pay any sales tax to them. The buyer is responsible for paying the sales tax according to the sales tax rate in the jurisdiction where you sell the vehicle.

You have to pay a use tax when you purchase a car in a private sale. New York is one of the five states with. Warranty fees see page 15.

While this question might seem a little complicated the answer is very straightforward and the simple answer is you dont have to pay taxes. Sales of educational services. Car Sales Tax for Private Sales in New York Private sales are also subject to the 4 state sales tax.

Among the common transactions that are not subject to the sales tax are the following. Private party sales within most states are not exempt from car tax but unlike dealer transactions the seller does not collect the car tax. The amount subject to tax includes all the following items.

When a dealer sells a motor vehicle to a resident of New York State the dealer must collect sales tax from the customer unless the sale is. Otherwise all other counties either charge 10 or 20 depending on your vehicles weight. Sales of prescription and nonprescription medicines.

The buyer will have to pay the sales tax when they get the car registered under their name. The state where you pay vehicle registration fees is the one that charges the sales tax not the state where you made the vehicle. Provide other acceptable proofs of ownership and transfer of ownership.

The dealer must reveal on the sales contract when a passenger car had been used primarily as a fleet car. Sign a bill of sale even if it is a gift or. If the new owner applies for an exemption from NYS sales tax for a reason different from a gift use form DTF-803 Claim for Exemption.

If NY State sales tax was paid to a NY State dealer the DMV does not collect sales tax when you apply for a vehicle registration and the DMV does not issue a sales tax receipt. Instead the buyer is responsible for paying any sale taxes. Register and title the vehicle or trailer or snowmobile boat moped or atv or transfer a registration from another vehicle.

Make sure the vehicle identification number VIN on the title matches the VIN on the car. You will pay it to your states DMV when you register the vehicle. Make sure to do your due diligence to avoid paying more than you need to.

If the VIN doesnt match have the seller correct it before you buy the car. Ad Free Fill in Legal Templates. The state of New York requires a used car tax in the form of sales tax.

Create a Personalized Bill of Sale for a Vehicle. For example Idaho charges a 6 tax which means you multiply the cost of the car 37851 and multiply it by 006. Box 68597 Harrisburg PA 17106-8597.

Once the lienholder reports to flhsmv that the lien has been satisfied. When a vehicle is sold in a private sale both the buyer and the seller must fill out a Statement of Transaction form DTF-802 which is then submitted to the New York DMV where the sales tax. Yes you must pay vehicle sales tax when you buy a used car if you live in a state that has sales tax.

You typically have to pay taxes on a car received as a gift in illinois. The tax due in is called use tax rather than sales tax but the tax rate is the same. After the title is transferred the seller must remove the license plate from the vehicle.

If NY State sales tax was paid to a NY State dealer the DMV does not collect sales tax when you apply for a vehicle registration and the DMV does not issue a sales tax receipt. It might sound obvious but a lot of people forget to check. The DMV office collects the sales tax from the new owner if the new owner is required to pay any sales tax.

Yes you must pay sales tax when you buy a used car if you live in a state that has sales tax. It ends with 25 for vehicles at least 11 years old. The bill of sale must indicate whether the vehicle is new used reconstructed rebuilt salvage or originally not manufactured to US.

There are also a county or local taxes of up to 45. Sales of medical care. You should expect to pay a four percent sales tax and an additional local tax of at least four percent depending on your locale within the state.

The license plate should be returned to PennDOT at Bureau of Motor Vehicles Return Tag Unit PO. That single missing digit voided the title. In this case its 37851 x 006 227106.

Sales or rentals of real property. The average total car sales tax paid in New York state is 7915. Transportation and destination charges.

In addition to taxes car purchases in New York may be subject to other fees like registration title and plate fees. Complete and sign the transfer ownership section of the title certificate and. Youll pay the 6625 percent state car sales tax when you bring the title to.

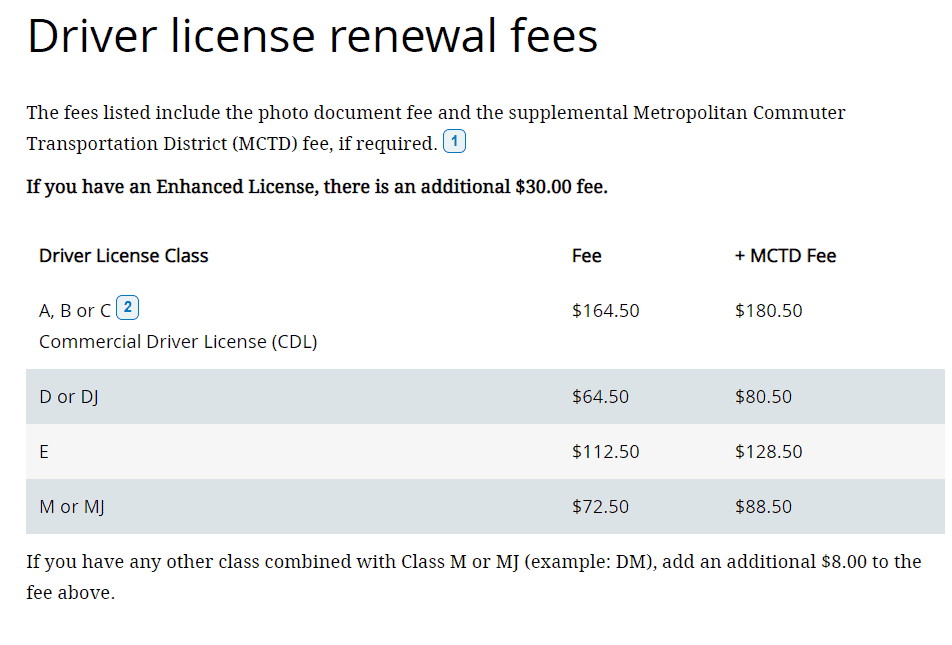

If i sell my car do i pay taxes. Supplemental MCTD is 50. Once the buyer has the vehicle registered under his name he must pay to sell Texas.

You can see the current sales tax rates by jurisdiction at the Department of Taxation and Finance web site. The sale price of the vehicle. This important information is crucial when youre selling.

Once you have purchased the vehicle from a private party you are responsible for paying the state sales tax to the New York State DMV. Sales of most personal services see for exceptions in New York City. When a dealer sells a motor vehicle to a resident of New York State the dealer must collect sales tax from the customer unless the sale is exempt see Part X.

That means Idaho charges a sales. Vehicles which are gifts are exempt from sales tax. New York City charges 30 the highest rate in the state.

The dealer must provide the buyer with odometer and salvage disclosure statements. The seller must indicate the mileage of the vehicle in the appropriate spaces provided on the ownership document. The highest possible tax rate is found in New York City which has a tax rate of 888.

New York collects a 4 state sales tax rate on the purchase of all vehicles. Who Pays Sales Tax When Selling A Car Privately In Florida Form 1181E Download Fillable PDF or Fill Online.

New York Dmv Chapter 3 Owning A Vehicle

:strip_icc()/buying-a-car-in-a-different-state-4148015-Final2-1a901895477c4c518d48407644568ce8.png)

Tips For Buying A Car In A Different State

What Are The Highest Paying Cyber Security Jobs Nyc Salary Guide Columbia Engineering Boot Camps

Work From Home Jobs In Ny Data Entry Home Business Ideas For Nurses Home Work From Home Jobs Home Jobs Working From Home

Pin On Legal Awareness Law Updates

Sql Consulting Development Software Development Sql

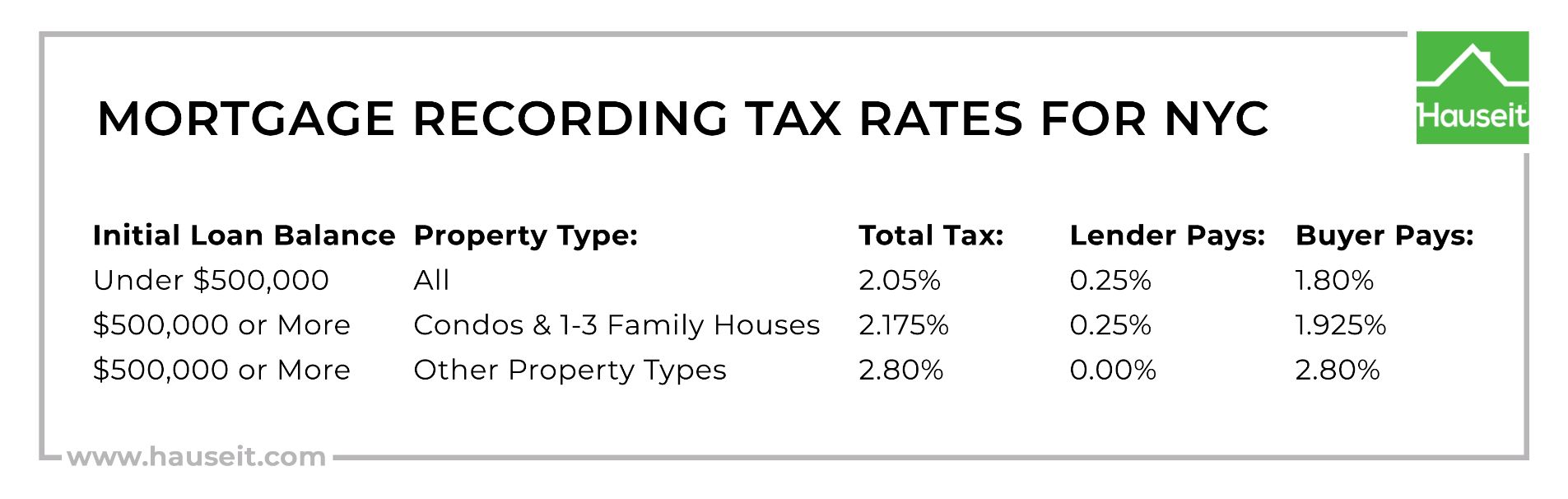

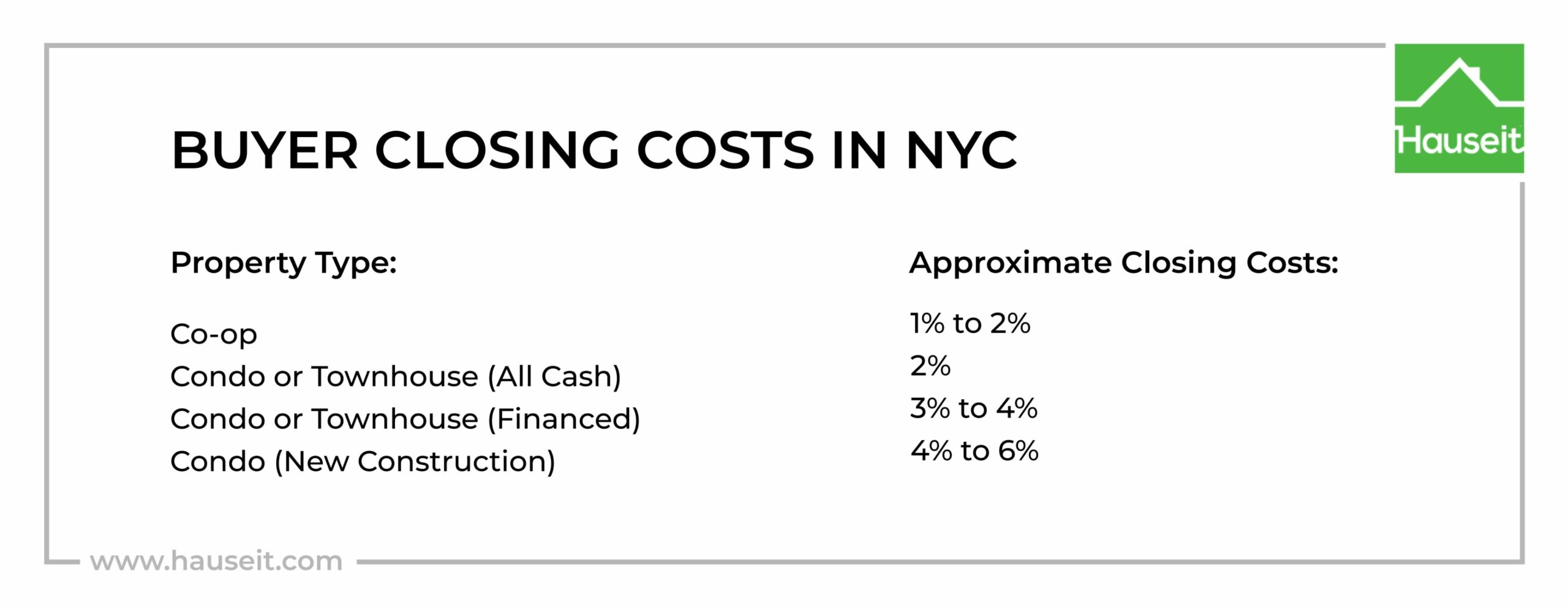

Nyc Buyer Closing Cost Calculator Interactive Hauseit

Work From Home Jobs In Ny Data Entry Home Business Ideas For Nurses Home Work From Home Jobs Home Jobs Working From Home

Nyc Buyer Closing Cost Calculator Interactive Hauseit

Gifting A Car In Ny Transfer The Ownership Of Your Vehicle In Nys Selling A Car In Ny

Car Sales Tax In New York Getjerry Com

Create Pay Stubs Instantly Generate Check Stubs Form Pros

How Much Does It Cost To Register A Car In Ny

Interview Not Enough Americans Pay Income Tax Should They

As Local News Dies A Pay For Play Network Rises In Its Place The New York Times

Unpaid Withheld Wages And Wage Supplements Department Of Labor